The world’s largest consumer research on accommodation plans and preferences

What’s new in 2026

Click to reveal the three emerging shifts in traveller behaviour for the year ahead

Three emerging shifts in traveller behaviour for the year ahead

Research

reshuffles

Research reshuffles

will start their hotel research on an OTA – overtaking search engines (21%) for the first time – while word-of-mouth doubles to 14% and AI gains momentum

The luxury

leap

The luxury leap

will choose superior or luxury rooms (+4pp), as more travellers prioritise elevated, memorable experiences

Smart shopping

grows

Smart shopping grows

who start their research on an OTA will book directly with their hotel (+3.3pp), seeking more control and better service

Research reshuffles

will start their hotel research on an OTA – overtaking search engines (21%) for the first time – while word-of-mouth doubles to 14% and AI gains momentum

The luxury leap

will choose superior or luxury rooms (+4pp), as more travellers prioritise elevated, memorable experiences

Smart shopping grows

who start their research on an OTA will book directly with their hotel (+3.3pp), seeking more control and better service

Global headlines

Five major stories revealing the mindset of tomorrow’s traveller

The AI takeover

Superstar destinations

The YOLO travel effect

The expanding value mindset

The privacy paradox

THE AI TAKEOVER 1 OF 4

AI goes mainstream

Travellers are flocking to AI. Its usage for accommodation research has grown almost 4x since last year, with more travellers now wanting AI-powered personalisation and assistance.

THE AI TAKEOVER 2 OF 4

Show me the money

Finances, above itineraries, are the main priority. Travellers now embrace AI during the booking process that protects their wallet first.

THE AI TAKEOVER 3 OF 4

The personal coach

Beyond wallet protection, travellers want AI to learn their personal habits—from dining preferences, to health needs, to noise tolerance—to deliver hyper-personalised travel recommendations.

THE AI TAKEOVER 4 OF 4

Empowerment or intrusion?

Asian countries and younger generations are showing the strongest enthusiasm for personal AI monitoring, while North American and older travellers still remain the most cautious.

SUPERSTAR DESTINATIONS 1 OF 2

Japan, USA and France maintain their dominance as dream destinations

The dream destination podium is unchanged but K-culture is pushing South Korea into the top tier. Spain will continue to drive demand in Europe, while Canada drops from the top 10.

SUPERSTAR DESTINATIONS 2 OF 2

5 of the top 10 dream cities are now in Asia

While Asian countries make up just 30% of the country rankings, they are stealing the spotlight at a city level, with Japan alone claiming three of the top five spots.

THE YOLO TRAVEL EFFECT 1 OF 2

Uncertainty sparks urgency

Recent global volatility has fuelled a ‘travel while you can’ mindset. Uncertain times are inspiring adventure, not creating hesitation.

THE YOLO TRAVEL EFFECT 2 OF 2

How are travellers changing their plans?

External factors aren’t just changing if people travel, they’re reshaping how they do it. Among those adapting their plans, more are booking earlier, travelling further and staying longer—while watching their budgets.

THE EXPANDING VALUE MINDSET 1 OF 3

Travellers welcome dynamic pricing

In 2026, more travellers will ‘strongly agree’ that demand should drive price, even if it costs them more during popular times.

THE EXPANDING VALUE MINDSET 2 OF 3

Paying with purpose

When it comes to paying more to combat overtourism, the largest share of travellers (42%) are willing—but they want guarantees. Among those willing to pay more, most either need it to be their only option or want transparency about how funds will help locals.

THE EXPANDING VALUE MINDSET 3 OF 3

Event-driven travel accelerates

63% of travellers are more likely to travel for special events in 2026. For these occasions, travellers will pay more, travel further and book earlier. A third of Gen Z and millennials will travel for concerts and festivals, while older generations will travel mainly for family celebrations. The future of hospitality pricing isn’t just about seasons anymore—it’s increasingly bound to experiences.

THE PRIVACY PARADOX 1 OF 2

Trust through transparency

Travellers aren’t afraid of hotel data personalisation, they just want to know what’s happening with their information. Conditional trust beats blind acceptance.

THE PRIVACY PARADOX 2 OF 2

The cultural data divide

Data privacy isn’t universal, it’s cultural. Opposition to hotels using personal data continues to vary by nationality—what feels like personalisation to someone from Bangkok could feel like surveillance to someone from Paris.

Traveller profiles

Essential insights to understand and attract key source markets

Australia

Canada

China

France

Germany

India

Indonesia

Italy

Mexico

Singapore

Spain

Thailand

UK

USA

The Australian traveller

In 2026, Australian travellers will be Google-faithful researchers, with the highest search engine usage globally. They’ll obsess over location details when booking and uniquely prioritise the little things that matter—one of just three countries choosing pillow perfection over peace and quiet. If you nail the overlooked comforts in a premium location, they’ll surely come back.

Pre-arrival journey

Google-faithful / Detail-conscious

On-property experience

Schedule-optimisers / Location-focused

Pre-arrival journey

Google-faithful / Detail-conscious

On-property experience

Schedule-optimisers / Location-focused

The Canadian traveller

In 2026, Canadian travellers will be the ultimate networkers, more likely than any other to start their accommodation hunt by asking friends and family for insider tips. When they book their stay, they’re quicker to pick up the phone than most and will almost always insist on paying with a credit card.

Pre-arrival journey

Friends & family-first / Credit card-champions

On-property experience

Standard room-lovers / Fast WiFi-demanders

Pre-arrival journey

Friends & family-first / Credit card-champions

On-property experience

Standard room-lovers / Fast WiFi-demanders

The Chinese traveller

In 2026, China’s travellers will top the list of luxury-seekers, gravitating toward boutique hotels and shunning Standard rooms for superior stays with breathtaking views. They’ll be the experience-obsessed globetrotters who value memorable moments, embracing TikTok property discovery, cutting-edge robotics and seamless digital wallets.

Pre-arrival journey

Mobile-first / AI-savvy

On-property experience

View-obsessed / Robot-ready

Pre-arrival journey

Mobile-first / AI-savvy

On-property experience

View-obsessed / Robot-ready

The French traveller

In 2026, French travellers will be perfectionist value seekers who demand room quietness above all else. They’ll escape to vacation rentals and campsites more than any other European guest, and they’ll be won over by properties that paint an irresistible picture through images and videos.

Pre-arrival journey

Vacation rental-lovers / Visuals-driven

On-property experience

Serenity-seekers / Parking-hunters

Pre-arrival journey

Vacation rental-lovers / Visuals-driven

On-property experience

Serenity-seekers / Parking-hunters

The German traveller

In 2026, German travellers will be the old-school value masters, calling to book Superior rooms directly and travelling solo more than any other nation. They’ll expect complimentary breakfast but resist extras, stick to traditional payment methods, and choose human interaction over emerging hotel technologies.

Pre-arrival journey

Security-prioritisers / Direct-connectors

On-property experience

Tech-resisters / Value-maximisers

Pre-arrival journey

Security-prioritisers / Direct-connectors

On-property experience

Tech-resisters / Value-maximisers

The Indian traveller

In 2026, India’s travellers will be adventure enthusiasts who demand excellence at every touchpoint – abandoning bookings when websites lag and carefully checking health and safety protocols. They’ll maximise their stays with flexible check-in/out times, upgrade to deluxe rooms and eagerly pay extra if it means a memorable hotel experience.

Pre-arrival journey

Safety-conscious / Impatient-bookers

On-property experience

Adventure-seekers / Room-upgraders

Pre-arrival journey

Safety-conscious / Impatient-bookers

On-property experience

Adventure-seekers / Room-upgraders

The Indonesian traveller

In 2026, Indonesia’s travellers will book through OTAs more than any other market. While they’re above average for starting their search on social media, they’ll ultimately convert through online travel agencies. They’re experience seekers who choose upgraded rooms with views and immerse themselves in on-property offerings like spa days and live music.

Pre-arrival journey

Social media-inspired / OTA-devoted

On-property experience

AI-embracers / Experience-chasers

Pre-arrival journey

Social media-inspired / OTA-devoted

On-property experience

AI-embracers / Experience-chasers

The Italian traveller

In 2026, Italian travellers will be drawn to unique independent hotels through captivating videos and images, always seeking the quietest rooms possible. They’ll indulge in hotel spas as their preferred luxury, value direct communication with their hosts and are the most likely traveller to venture both internationally and domestically.

Pre-arrival journey

Globe-and-home explorers / Direct-communicators

On-property experience

Spa-enthusiasts / Quiet-seekers

Pre-arrival journey

Globe-and-home explorers / Direct-communicators

On-property experience

Spa-enthusiasts / Quiet-seekers

The Mexican traveller

In 2026, Mexico’s travellers will be gravitating toward well-known hotel chains and booking directly for peace of mind over third-party sites. They’ll scrutinise every package offer, prioritising those with breakfast and adventure activities included, and place value on outstanding customer service.

Pre-arrival journey

Groups & Chains-fans / Package-hunters

On-property experience

Adventure-seekers / Breakfast-enthusiastst

Pre-arrival journey

Groups & Chains-fans / Package-hunters

On-property experience

Adventure-seekers / Breakfast-enthusiastst

The Singaporean traveller

In 2026, Singapore’s travellers will be the most internationally-minded, with 64% venturing exclusively abroad. They’ll book through OTAs based on one key priority: prime location. They demand lightning-fast WiFi and premium bedding, get swayed by complimentary upgrades and readily pay extra for flexible check-in/out times.

Pre-arrival journey

Passport-ready / Upgrade-sensitive

On-property experience

Wifi-dependant / Comfort-seekers

Pre-arrival journey

Passport-ready / Upgrade-sensitive

On-property experience

Wifi-dependant / Comfort-seekers

The Spanish traveller

In 2026, Spain’s travellers will be all about trust – increasingly seeking recommendations from friends and family while staying loyal to familiar hotel brands with passionate staff. They’ll be selective spenders who skip room upgrades in favour of specific comforts: perfect temperature control, optimal shower pressure, reliable airport transfers and convenient parking.

Pre-arrival journey

Word-of-mouth-reliant / Selective-spenders

On-property experience

AC-seekers / Service-obsessed

Pre-arrival journey

Word-of-mouth-reliant / Selective-spenders

On-property experience

AC-seekers / Service-obsessed

The Thai traveller

In 2026, Thailand’s travellers will be digital-savvy researchers discovering their ideal stay through social media and travel blogs, with B&Bs emerging as their favourite. They’ll scrutinise every review and security detail while seeking indulgent yet sustainable experiences—expect them to choose eco properties where they’ll splurge on organic dining and wine tastings.

Pre-arrival journey

Social media-influenced / Review-attentive

On-property experience

Sustainability-enthusiasts / Flavour-chasers

Pre-arrival journey

Social media-influenced / Review-attentive

On-property experience

Sustainability-enthusiasts / Flavour-chasers

The UK traveller

In 2026, UK travellers will be detail-oriented planners who research thoroughly on OTAs, booking wherever offers maximum flexibility. They’re location-obsessed, scrutinising positioning above all and returning to hotels in prime spots. They want reliable WiFi, private balconies, and human service—not robots or crypto payments, which they’re least likely to use alongside the French.

Pre-arrival journey

Tech-traditionalists / Flexibility-focused

On-property experience

Tea-lovers / Balcony-seekers

Pre-arrival journey

Tech-traditionalists / Flexibility-focused

On-property experience

Tea-lovers / Balcony-seekers

The American traveller

In 2026, American travellers will lead the world in direct bookings, going straight to hotel websites more than any other market. They’re the most domestically-focused travellers globally, often sticking to familiar chains and demanding clear value. Once they find it, they’ll return loyally—especially if there’s freebies involved.

Pre-arrival journey

Direct-bookers / Brand-loyals

On-property experience

Content-streamers / Freebie-seekers

Pre-arrival journey

Direct-bookers / Brand-loyals

On-property experience

Content-streamers / Freebie-seekers

Explore more traveller profiles

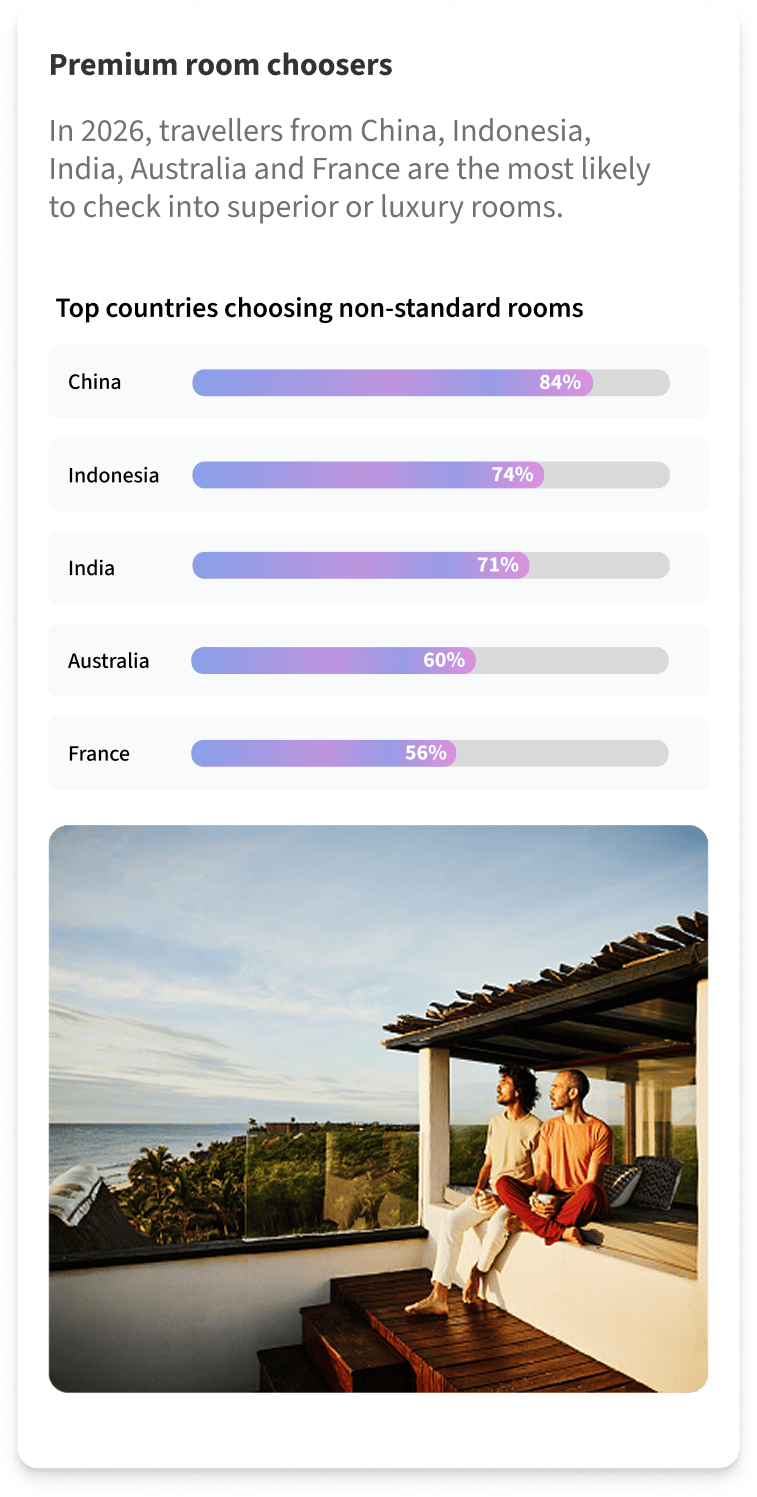

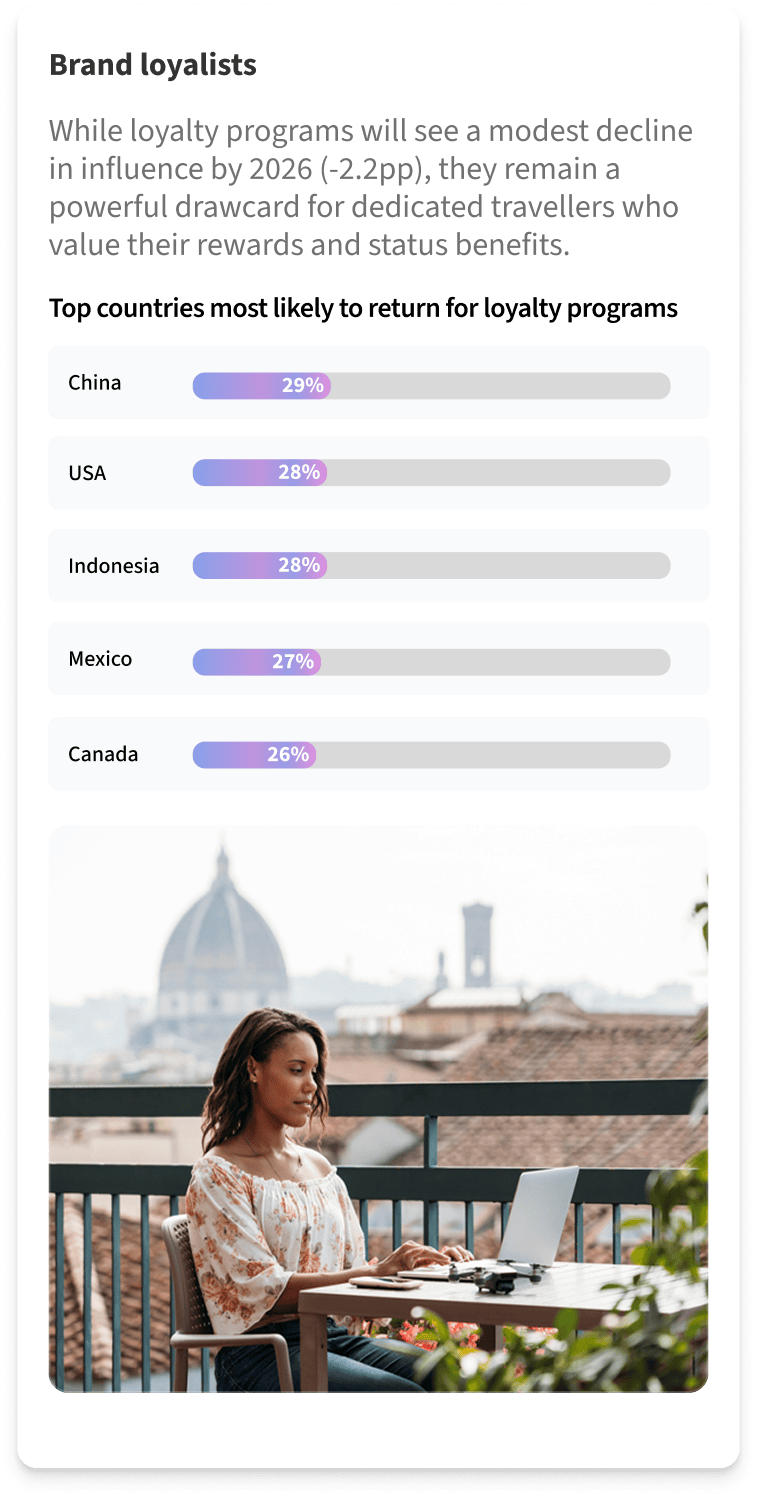

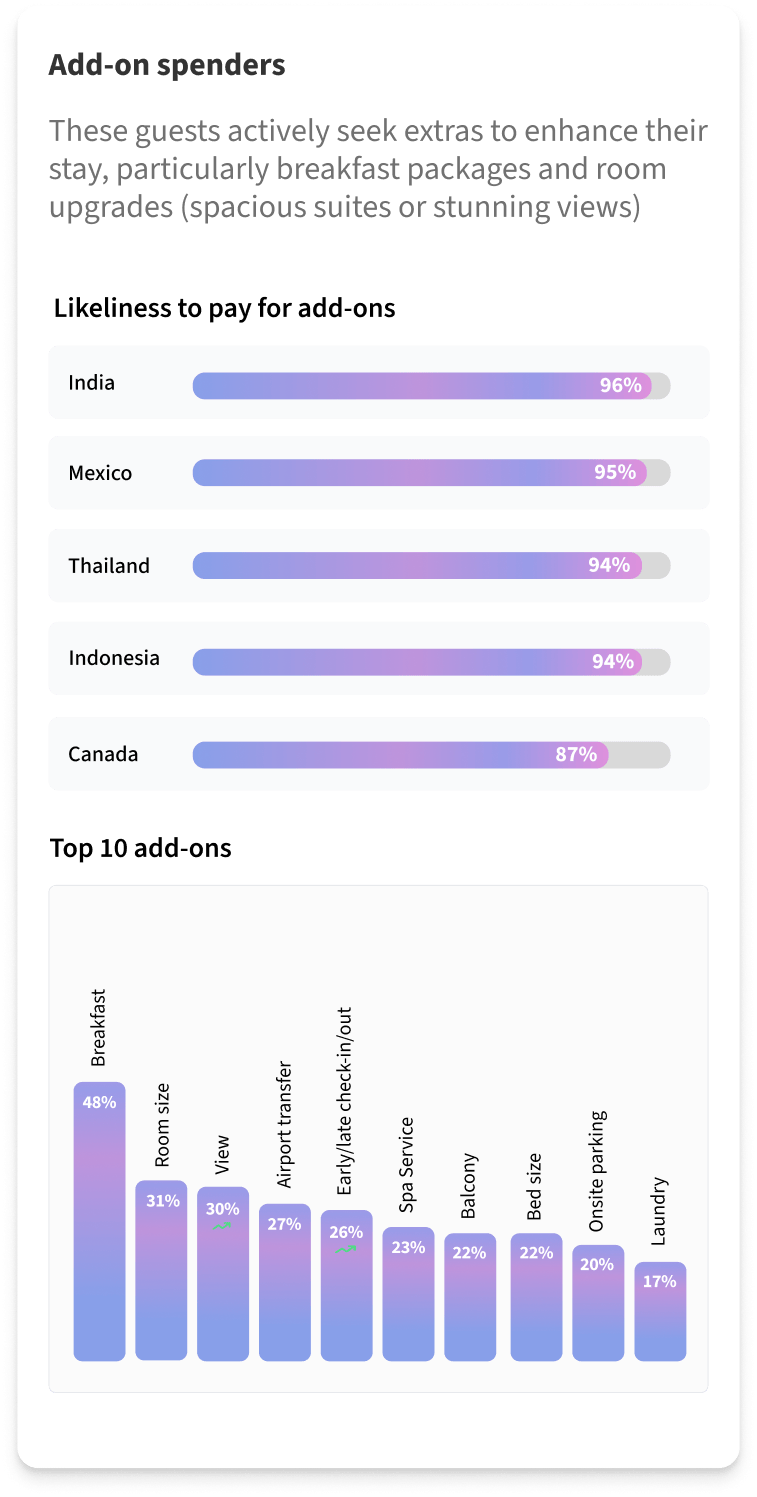

Money makers

The travellers who’ll deliver the most value through premium choices and extras

Premium room

choosers

Brand

loyalists

Add-on

spenders

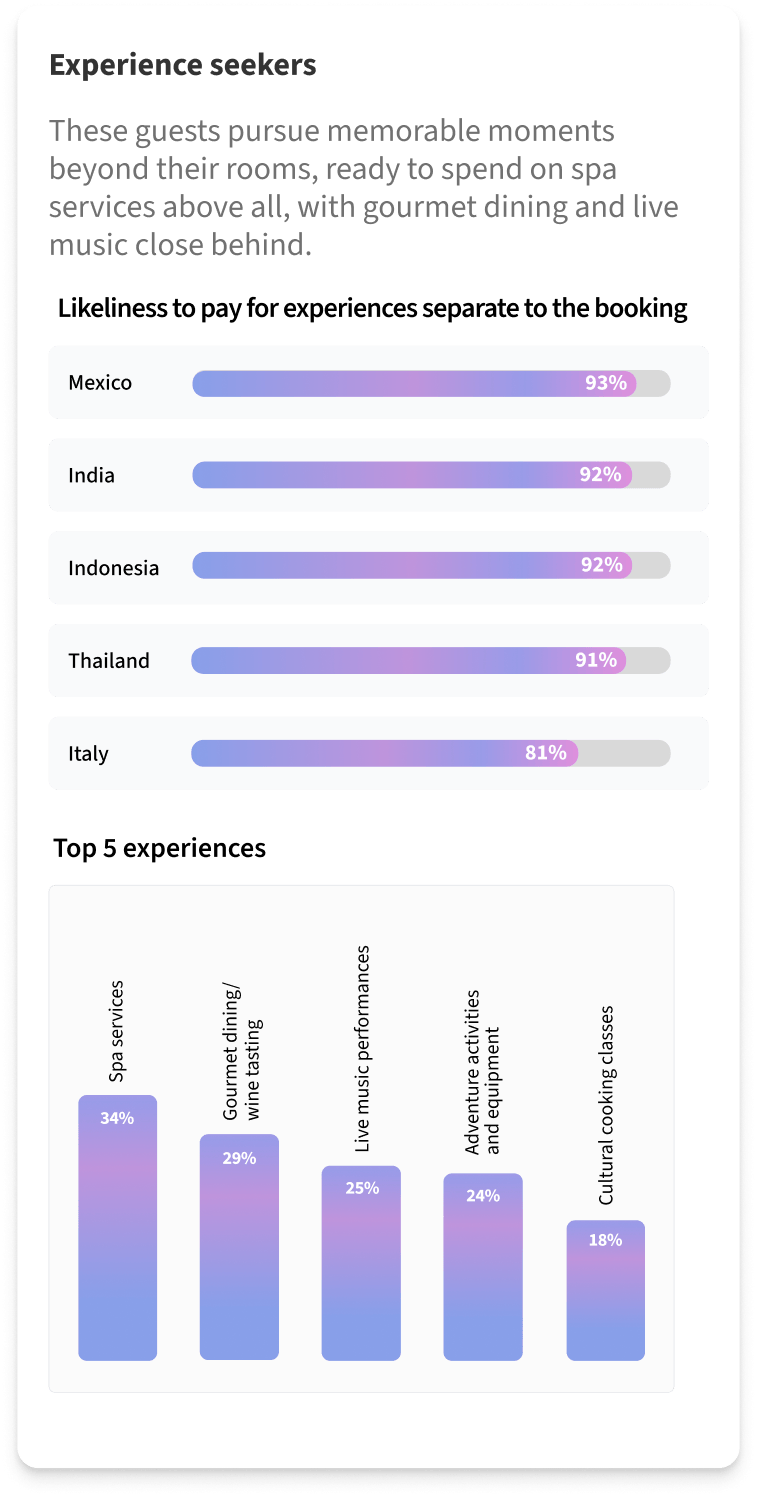

Experience

seekers

Access the Hotelier’s Playbook

Turn traveller insights into your playbook for revenue success.

Built on SiteMinder’s Changing Traveller Report 2026, this Playbook reveals how evolving traveller trends impact your property and gives you the practical steps to stay ahead, helping you make smarter decisions, capture more guests and command greater revenue.