What is hotel insurance?

Hotel insurance is a specific type of insurance designed to give hospitality businesses monetary protection against various risks and liabilities. It’s essentially a safety net that allows hoteliers to protect their property from unforeseen circumstances such as damage or theft. Having insurance can go a long way to help ensure that your hotel can enjoy long-term success.

Given that hotels can be unique accommodations and physical buildings, insurance policies will often also take into account all the different amenities and spaces within the property too. This might include the bar, gym, pool, and conference rooms.

How much does hotel insurance cost?

The cost of hotel insurance has no definitive number, since there are so many variables based on the unique circumstances of your hotel and the types of insurance you’ll need or choose.

The cost of your insurance will largely depend on:

- Size of your hotel: Larger hotels generally require higher coverage and therefore higher premiums.

- Location: Is your property in a high-risk area (e.g. natural disasters or crime)? If so, the insurance costs will likely be higher.

- Hotel type: A budget hotel will have a different profile to a luxury hotel for example, and will have different insurance cost outcomes.

- Coverage limits: The amount of coverage you choose will impact the premium. Higher coverage limits typically result in higher premiums.

- Deductible: A higher deductible can lower your premium but means you’ll pay more out of pocket for claims.

- Provider: Not all insurers have the same structures or assessments, so you’ll need to do some research.

As a general guide, a very small B&B might only have insurance premiums of less than $5,000/year, while a larger luxury property might be paying $20,000+.

For example, hotel insurance in the UK can be as little as £1,050 per annum for small hotels and B&Bs.

Where to get a hotel insurance quote?

Generally, there are three ways to source an insurance quote for your hotel:

- Use a broker to find a provider and negotiate a policy for you.

- Deal directly with a local insurance company in your country or region.

- Use online marketplaces to research and compare your options.

The more information you can provide and the more questions you can answer about your business, the more accurate and beneficial your quote will be.

In this blog, we’ll provide a comprehensive guide to hotel insurance, including what it can cover for your property, how it works, and what it might cost your hotel business.

Table of contents

Why are hotel insurance programs important?

With so much activity happening and many different amenities and services running, hotels can be exposed to quite a large degree of financial risk. The potential risk of injury, damage, or theft is high – and that’s before even taking into account factors such as weather events.

From guest disputes, to staff compensation, to property damage and even collisions involving your shuttle transport, your hotel is always facing some kind of financial challenge. However, many businesses are not always prepared. For instance, a study revealed that up to 57% of Australian small and medium businesses might be underinsured.

Hotel insurance programs ensure that you are protected and can be covered for any hardship you encounter, allowing you to maintain effective revenue management. With a hotel insurance policy, you can gain more confidence that your business can survive long-term. It also helps your property continue running smoothly when something does occur, because you don’t have to spend time stressing or looking for other solutions.

With such a variety of risks – this means it’s also important to consider a variety of hotel insurance types, or a comprehensive insurance strategy, to make sure nothing slips through the cracks. For example, worker’s compensation will come under a completely different type of insurance to fire damage to the property.

Reduce costs and boost revenue with the right tech Take the pressure off your hotel insurance costs by using SiteMinder’s platform to boost bookings and revenue, satisfy guests, and maintain data security.

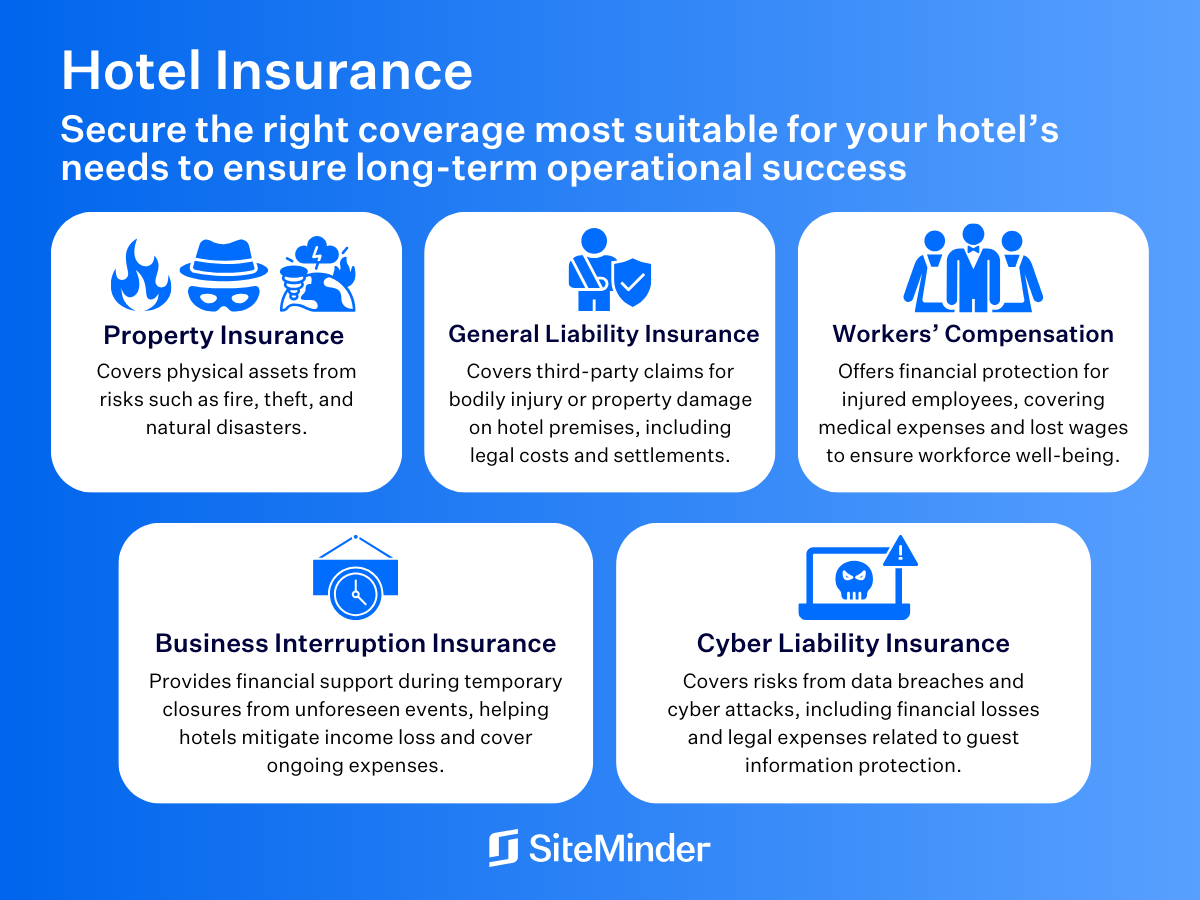

What’s included in hotel insurance coverage?

To get a full picture of what might be included in hotel insurance coverage, we have to consider all the various types of hotel insurance. Let’s take a look at 8 categories:

1. Property damage

Perhaps the most common, this insurance type will cover damage to your physical property or the equipment and furniture inside. However, it may also apply to property belonging to the guest as well.

2. Loss of income

Rather than just insurance to repair damage, you might also need insurance to cover the money you’ll lose if you have to shut your hotel for a period of time.

3. Machinery breakdown

This refers to failure of appliances such as fridges which result in the spoiling of food and beverages, leading to increased costs and loss of revenue.

4. Public and product liability

Another common insurance type which operates to protect against negligent actions by your or your staff, or as result of injury/illness from a product supplied by you. It will also include risks such as liquor – trips and falls due to intoxication – and food and beverage (burns from hot food or liquids).

Are hotels liable for stolen property? If a guest has property stolen, your hotel may or may not be liable. It depends on the circumstances of the theft and also the local laws and regulations.

5. Cyber security

Data security is becoming more and more important, and in the case of hotels there is a lot of potential harm. In the case of big chains, large amounts of personal customer information presents a valuable target for hackers and scammers.

6. Coastal property insurance

If you’re in the niche situation of owning or operating a waterfront accommodation, you can insure against events such as hurricanes, windstorms, erosion, and more.

7. Auto insurance

Another niche example is if your hotel operates a fleet of vehicles for guest transportation or other purposes. You might want to protect against loss or damage of these vehicles, and in some cases you may be required to have insurance to even drive them in the first place.

8. Hotel umbrella insurance

Hotel umbrella insurance, or commercial umbrella insurance, refers to claims that are outside your other liabilities which may help you avoid out-of-pocket expenses.

Key hotel insurance requirements: Worker’s compensation

The staff at your hotel are just as important as your guests – they are often facing the same risks and may have similar claims. So it’s vital you are covering worker’s compensation in your insurance plans.

It’s a legal requirement in many jurisdictions to protect both employers and employees in case of workplace injuries or illnesses, and typically covers:

- Medical expenses: This includes costs of doctor visits, surgeries, medications, and physical therapy.

- Lost wages: If an employee is unable to work due to a work-related injury or illness, worker’s compensation can provide wage replacement benefits.

- Vocational rehabilitation: If an employee is unable to return to their previous job, worker’s compensation may cover the cost of job retraining or vocational rehabilitation.

- Death benefits: In the tragic event of a work-related fatality, worker’s compensation may provide death benefits to the employee’s family.

Worker’s compensation insurance provides a safety net for both the employer and the employee.

For your hotel, this includes:

- Legal Compliance: Failing to have worker’s compensation insurance can result in significant fines and penalties.

- Risk Management: It helps protect the business from lawsuits and financial losses.

- Employee Morale: Providing worker’s compensation benefits can improve employee morale and loyalty.

And it gives your staff peace of mind and financial security, potentially increasing their satisfaction and loyalty.

How to find the best hotel insurance policy

Finding the best hotel insurance policy involves careful consideration and comparison.

Here are some of the most important steps.

- Understand your specific needs: How much insurance will you actually need? Take into account how big your property is, how many staff you have, what amenities you have, and where your property is located. For example, if you own and operate a B&B yourself, you probably won’t need cover for worker’s compensation.

- Procure multiple quotes: To get the most appropriate coverage and the best deal, you should contact at least a few providers to see what they can offer. Remember to read the fine print.

- Do your due diligence: A provider may seem solid on the surface but be sure to choose an insurance partner that is reliable and financially stable. It’s a good idea to look at reviews and the history of the business.

- Regularly review your terms: Re-evaluate your needs as your business grows and changes, since your insurance needs may change as well.

Should you use hotel insurance brokers?

It can definitely be beneficial to consult with a hotel insurance broker. Insurance brokers specialise in understanding the unique needs of the hospitality industry. They can tailor a policy to your specific needs and risk profile and also negotiate with insurers to get the best rates and coverage.

Common hotel insurance companies

If you’re looking for a few examples of who might be able to insure your business, here are some common companies from around the world.

Hotel insurance in Australia

- Allianz Australia: A major insurer offering a range of business insurance products, including those tailored to the hospitality industry.

- QBE Insurance: Provides comprehensive insurance solutions for businesses, including hotels and motels.

- AIG Australia: Offers a wide range of insurance products, including property, liability, and cyber insurance for hotels.

- Marsh: A global insurance broker that can help you find the right insurance coverage for your hotel business.

Hotel insurance in the United States

- Chubb: A leading global insurer offering a variety of insurance products for hotels, including property, liability, and cyber insurance.

- Travellers: Provides comprehensive insurance solutions for the hospitality industry, including property, casualty, and workers’ compensation insurance.

- Hartford: Offers a range of insurance products for hotels, including property, liability, and business interruption insurance.

- Cincinnati Financial: Provides insurance solutions for hotels, including property, liability, and workers’ compensation insurance.

Hotel insurance in the United Kingdom

- Aviva: A major insurer in the UK offering a range of insurance products for hotels, including property, liability, and business interruption insurance.

- AXA: A global insurer offering a variety of insurance products for hotels, including property, liability, and cyber insurance.

- Hiscox: Provides specialised insurance solutions for businesses, including hotels and hospitality venues.

- Zurich: Offers a range of insurance products for hotels, including property, liability, and business interruption insurance.

Boutique hotel insurance

We mentioned that some properties will have different insurance needs and circumstances than others. Boutique hotels are a unique property type which can often feature expensive artworks, antique furniture, and specialised amenities or equipment. For this reason, your property may need additional insurance coverage to adequately protect your income.

Luxury hotel insurance

Similarly, luxury hotels house very valuable items, products, and services including a number of different staff positions, in-room amenities, and property-based experiences. It may be the case that you’ll need higher liability or property protection limits.

With hotel insurance providing peace of mind, you can also reduce the stress of running your property by using cutting-edge technology…