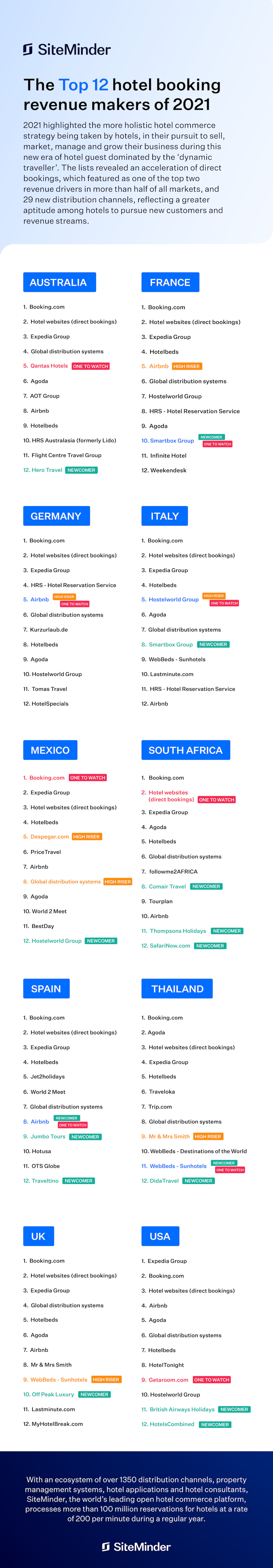

Sydney, Australia – SiteMinder, the world’s leading open hotel commerce platform, has today unveiled the lists of distribution channels that brought the highest booking revenue to hotels over the past year, in more than 20 of the world’s most popular tourism destinations.

The lists reveal a more holistic online commerce strategy, consisting of both new and established methods, is being taken by hotel businesses to reach new customers and produce revenue. This holistic commerce strategy consists of a greater balance between direct and indirect revenue streams, with direct bookings now one of the top two revenue drivers in more than half (12) of global markets—up from five markets last year and two in 2019—driven by increased investments in booking engines, hotel websites, metasearch, frictionless payments, support from hotel consultants and specialist applications designed for conversion.

This year’s lists also feature 29 new distribution channels, reflecting the current aptitude among hotels to embrace new revenue streams in their pursuit of new customers. Additionally, the lists increasingly feature Airbnb, which has risen in 12 markets and debuted in three, in spite of the channel being made available to traditional hospitality businesses only four years ago.

Other major findings supporting a greater adoption of a holistic hotel commerce strategy included:

- The maintained relevance of regional channels, particularly in locations with ongoing reduced international travel. Channels such as AsiaYo and ezTravel in Asia, Hero Travel in Australia, Kurzurlaub in Austria, Tiket.com in the Philippines, SafariNow.com in South Africa and Off Peak Luxury in the UK are all new arrivals on SiteMinder’s lists this year. In Indonesia, Traveloka achieved a breakthrough performance to top the list of revenue generating channels for local hotels, after rising to second place in 2020.

- The ongoing importance of wholesalers for many accommodation providers, with leading bedbank Hotelbeds again among the Top 12 in each destination examined – and Sunhotels by WebBeds a newcomer to SiteMinder’s Austrian and Thai lists.

- The consistent performance of global distribution systems, which rose two or more positions in seven markets—Asia, Canada, Mexico, the Middle East, the Netherlands, Philippines and Thailand.

“We’re living in a new era of hotel guest, dominated by what we’ve identified as the ‘dynamic traveller’ who comes with evolved booking behaviours and preferences. Our data highlights the willingness of hoteliers to adopt both new and established methods to attract these customers, as they pursue a more holistic hotel commerce strategy to sell, market, manage and grow their business,” says SiteMinder’s senior director of global ecosystem, James Bishop.

“Most clearly, the rise of direct bookings reflects the grown investments we’ve seen among hotels in their websites—including their booking engines and payment options, and the specialist conversion tools they connect with—as well as their metasearch strategies and local hotel consultant support. Meanwhile, a newcomer cohort of 29 channels showcases the openness of hotel businesses to employ a broader, multichannel approach as a way of connecting with more niche or harder-to-reach customer segments.

“The popularity of Airbnb comes as no surprise. As many travellers continue to seek out accommodation options that allow work and travel to seamlessly meet, hotel distribution channels catering to longer stay and workation guests will continue to perform strongly.”

Click here to view the Top 12 lists of all travel destinations worldwide, and insights into the 2022 traveller from top distribution channel providers.

Media enquiries

Maria Cricchiola

+61 2 8031 1287

media@siteminder.com

Investor information

Ronn Bechler

+61 400 009 774

investor.relations@siteminder.com

About SiteMinder

SiteMinder (ASX:SDR) is the world’s leading open hotel commerce platform, ranked among technology pioneers for opening up every hotel’s access to online commerce. It’s this central role that has earned SiteMinder the trust of tens of thousands of hotels, across 150 countries, to sell, market, manage and grow their business. The global company, headquartered in Sydney with offices in Bangkok, Berlin, Dallas, Galway, London and Manila, generated more than 100 million reservations worth over US$35 billion in revenue for hotels in the last year prior to the start of the pandemic.