What is EBITDAR?

EBITDAR stands for earnings before interest, taxes, depreciation, amortisation, and restructuring or rent costs (EBITDAR). It’s useful for businesses such as hotels, restaurants or casinos that have unique or variable rent costs.

EBITDAR exists alongside, but should not be confused with, earnings before interest and tax (EBIT) and earnings before interest, tax, depreciation, and amortisation (EBITDA).

It helps analysts understand the ability of the business to generate profits, even after spending huge rent or restructuring costs as a part of its operations.

EBITDAR is yet another way to track your hotel’s financial health. You might be more used to tracking metrics such as RevPAR, TrevPAR, or GOPPAR, but EBITDAR can really help you measure your performance against similar properties in the industry.

Let’s dive deeper into EBITDAR, why hotels should use it, how to calculate it, and how it can help increase hotel revenue.

Table of contents

Why should hotels use EBITDAR?

For hotels, EBITDAR offers a more comprehensive view of operational performance by excluding the costs associated with property rentals or leases. This is crucial because, unlike other businesses, hotels often have substantial rental or lease expenses, which can distort the true picture of their operational efficiency when using traditional metrics like EBITDA.

By using EBITDAR, hoteliers can make more informed decisions about their operations, identify areas for improvement, and benchmark their performance against competitors in a more apples-to-apples comparison. In an industry where margins can be thin and operational efficiency is paramount, EBITDAR serves as a valuable tool for hotel managers and investors alike.

Master EBITDAR optimisation with SiteMinder SiteMinder simplifies the hotel finance process, offering tools and insights to help you optimise your EBITDAR and drive profitability.

EBITDAR vs EBITDA: Is it the same?

EBITDAR and EBITDA are similar, except that EBITDAR excludes restructuring and/or rent costs.

Both are used to compare the performance of two companies but using EBITDAR better allows you to remove variability from your analysis.

EBIT is also used as a basis for both metrics, and is needed before you start calculating your EBITDAR.

How to calculate EBITDAR

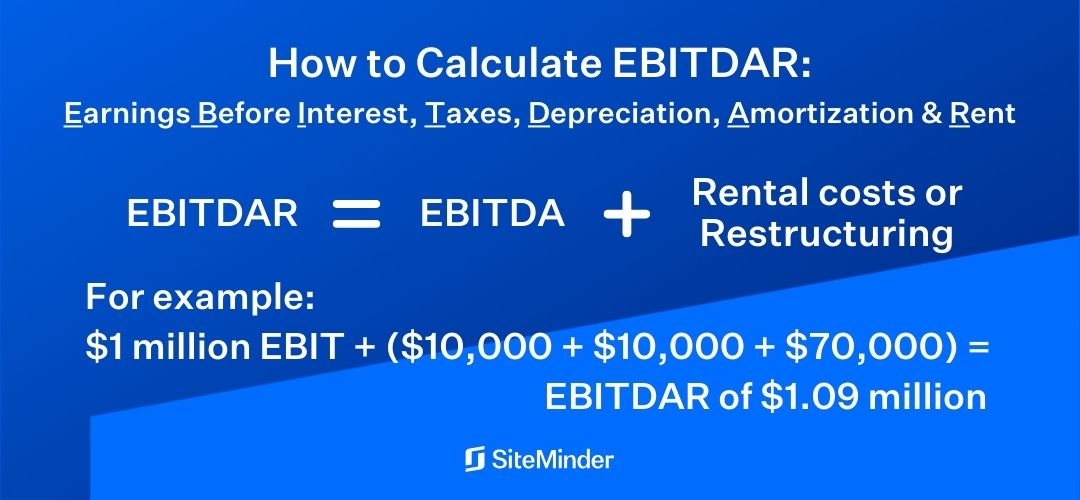

EBITDAR = EBITDA + Restructuring/Rental Costs

Remembering that: EBITDA = Earnings before interest, taxes, depreciation, and amortisation.

For example, if your hotel earns $1.6 million in a year, and it has $600,000 in total operating expenses, you first need to subtract operating expenses from revenue. This results in $1 million of EBIT (operating income).

Now consider that within the operating expenses there is depreciation of $10,000, amortisation of $10,000, and rent of $70,000.

To find the EBITDAR, you need to exclude depreciation, amortisation and rent ($10,000 + $10,000 + $70,000). This means adding it back onto your operating income.

EBITDAR = $1 million EBIT + ($10,000 + $10,000 + $70,000) = $1.09 million.

What is a good EBITDAR?

For many hotels, EBITDAR may not be that different from EBITDA. As such, you can apply the same margin benchmark as EBITDA: around 10% can be considered a strong EBITDAR margin (EBITDAR / total revenue).

Optimise your pricing and maximise room revenue

SiteMinder connects with leading revenue management systems to automatically update your optimised rates across all distribution channels in real-time, maximizing the yield of every room through intelligent pricing.

Learn More

When to use EBITDAR

Using EBITDAR is particularly helpful when comparing peer companies within the same industry, or even different properties within the same company, as it reduces variability.

For example, similar hotels in different cities and different parts of a country will have significantly different rent costs. Using EBITDAR allows you to compare the performance of the properties based on their core income activities, giving you a clearer picture of which one is more profitable.

Note that EBITDAR is most applicable for large businesses or businesses with a lot of assets, such as an enterprise level hotel brand.

It can help with:

- Viewing overall performance

- Comparing performance

- Budgeting and restructuring decisions

- Investing

Benefits of using EBITDAR formula for hotels

Using EBITDA as part of ongoing performance analysis has a number of advantages for hotels:

- Financial performance – EBITDAR gives a more accurate representation of a hotel’s earnings by excluding rental and lease expenses. This allows stakeholders to gauge the true profitability and financial health of the establishment.

- Comparison of other properties – By using EBITDAR, hoteliers can benchmark their property against competitors or other properties within a chain, ensuring a fair comparison that excludes varying rental or lease costs.

- Operational efficiency – This metric focuses on the core operations of a hotel, helping management identify areas of improvement and streamline processes for better profitability.

- Valuation of asset – EBITDAR can be a crucial factor when determining the value of a hotel as an asset, especially when considering potential sales or acquisitions.

- Management evaluation – By excluding external financial obligations, EBITDAR allows for a clearer assessment of management’s effectiveness in running the hotel’s core operations.

- Risk assessment – EBITDAR can highlight potential financial risks by providing a clearer picture of earnings before major expenses. This can be instrumental in making informed decisions about future investments or operational changes.

- Transparency – For investors and stakeholders, EBITDAR offers a transparent view of a hotel’s performance, ensuring that they have a clear understanding of where the hotel stands financially without the distortion of rental or lease costs.