What is hotel revenue management?

Hotel revenue management is the strategic distribution and pricing tactics used to sell perishable room inventory to the right guests at the right time in order to boost revenue growth. Other products such as hotel amenities and food and beverage offerings will also form part of the strategy.

Revenue management revolves around measurement of what customers from different audience segments are willing to pay, as well as the ever-changing supply and demand within each market. This can only be done by measuring and monitoring the demand of your hotel rooms. It involves the use of data and analytics to help you keep track of supply and demand so you can make predictions on consumer behaviour.

This then allows you to make informed decisions on what accommodation to promote to the right client, at the right time, with appropriate pricing through the most suitable distribution channel.

This blog will tell you everything you need to know about hotel revenue management, including how to optimise your strategy and look for the best solutions to help. Table of contents

What is strategic revenue management in the hotel industry?

Strategic revenue management in the hotel industry is using distribution strategies and pricing tactics to better attract, secure, and retain guest bookings.

Now, more than ever, revenue management is the cornerstone of running a successful and profitable hotel. The growth of data that’s now readily available as well as the ways to track and analyse it provides a wealth of new opportunities for your business to turn a profit.

The most successful hoteliers are savvy operators who continually look for ways to learn and improve the way they do things, gaining an edge over the competition.

Yet, only a small percentage of independent hoteliers use revenue management strategies and thus limit their revenue-generating potential.

More revenue, less work What if you could take a dynamic approach to your hotel's revenue performance while also reducing your workload? Our smart hotel platform helps you do exactly that.

What is the primary purpose of revenue management?

The primary purpose of revenue management is to optimise revenue and profitability by strategically managing room rates, inventory, and distribution channels. A hotel’s most precious commodity, the perishable room night product, is at the heart of all revenue management activities.

There are many ways you can approach this, from motivating guests to book directly to offering extended stays, up-sells or extras as well as encouraging guests to become a return visitor.

Optimal strategies and techniques are dynamic, based on the understanding that hotel pricing is fluid and can change from one day to the next.

This is a key reason why you should never be afraid to increase your rates, and this may be surprising, but customers actually expect increases over time. Many businesses where consumers spend money have varying prices based on demand, supply and shifts in costs.

Why is revenue management important for the hotel industry?

Revenue management is essential for any hotel today. Without it, your business is essentially forfeiting the ability to boost bookings, revenue and profit, offer competitive rates and promotions, and forecast effectively.

The fluctuating demand, strong competition, and ever-changing e-commerce landscape in hospitality necessitate constant attention and strategic adaptation. Revenue managers must continuously monitor property performance, market trends, competitor pricing strategies, brand impact, and consumer behaviour to optimise their return on effort. Revenue managers have a tough gig!

Effective hotel revenue management strategies and techniques can also help you:

- Better manage resources

- Protect against rostering too many staff during slow periods

- Ensure adequate numbers of staff are working during the busiest times

For many properties, revenue earned from room stays represents the larger share of their total revenue earned. This means that effective revenue management can sit in the driving seat of business profitability goals.

Your hotel distribution strategy is also a vital part of your revenue management plan; make sure you’re on internet distribution channels that are cost-effective, easy to manage, and are able to deliver the bookings you need from the markets you are best-positioned to source guests from. The right distribution channels can have strong marketing power, putting your hotel in front of many customers you aren’t able to contact directly.

By using smart technology and a trusted dataset, hoteliers are able to predict market demand,and react to changes in the market dynamically. Adaptability is critical to achieve the best revenue management results. Adopting new strategies and/or systems in order to maintain high levels of performance is also critical (where necessary).

What are the key elements that impact revenue management in hotels?

Revenue management has long been a relatively straightforward practice, although most revenue managers will argue that it doesn’t mean it’s simple. It involves the careful analysis and application of big data, metasearch, RMS technology, rate parity tactics, among others.

Here are the key elements that impact revenue management in hotels:

1. Big data

With the growth of big data, it’s now easier than ever for your hotel to understand their market. Insights like your competitive set, historical performance, market and guest booking trends, and much more are now available on demand. Advances in revenue management technology have also seen the introduction of more sophisticated measures of a hotel’s performance.

That said, one has to ask: why are so many hotels’ margins still being eroded away by OTAs? It would seem that more advanced revenue practices should lead to greater profitability for the hotel, but that has not necessarily been the case.

2. The growth of metasearch

OTAs often outperform individual hotels in metasearch positioning and cost-per-click (CPC) performance. They typically have larger advertising budgets and greater resources to invest in metasearch advertising, allowing them to bid more aggressively for top placement in search results.

Additionally, OTAs aggregate a wide range of hotel options, providing users with a one-stop-shop for comparison shopping, which can attract more clicks and in turn, improved positioning.

Furthermore, OTAs often have sophisticated technology and data analytics capabilities, enabling them to optimise CPC campaigns based on real-time market trends, consumer behavior, and conversion metrics.

This combination of greater financial resources, broader inventory, and advanced technology gives OTAs a competitive edge in metasearch positioning and CPC performance compared to individual hotels.

3. RMS technology

The most modern Revenue Management Systems (RMS) and other revenue management and distribution tools are able to apply dynamic pricing strategies in real-time, adapting to changes based on market demand and competitor pricing.

Some OTAs still use cached pricing. Issues with cached pricing occur when OTAs store pricing data temporarily to improve website performance, leading to discrepancies between the prices displayed to users and the actual prices at the time of booking. This can potentially lead to customer dissatisfaction and revenue loss for hotels if customers perceive inconsistencies or discrepancies in pricing across different channels.

4. Rate parity

Finally, rate parity continues to be an obstacle for hotels seeking to have more control over their pricing structures. Most OTAs – in particular, those with global reach – have automated tools which regularly check to ensure that hotels are offering guests who visit their website the best available rate and monitor rate parity.

This means it can be challenging for your hotel to offer special prices or other deals without affecting your property’s positioning on a top-performing OTA. Offering Closed User Group (CUG) promo codes, building packages from your direct booking site or including unique value-adds are among the best ways to offer value to your guests who book direct without it affecting your OTA rate parity

Optimise your pricing and maximise room revenue

SiteMinder connects with leading revenue management systems to automatically update your optimised rates across all distribution channels in real-time, maximizing the yield of every room through intelligent pricing.

Learn More

How does the hotel revenue management process work?

Hotel revenue management is a nuanced process, incorporating competitive analysis, forecasting, pricing, inventory management, and monitoring. It’s all intricately designed to optimise a hotel’s profitability by balancing room rates with demand. This dynamic approach requires a blend of data analysis, market insight, and strategic action. Here’s a deeper dive into how the process unfolds:

Step 1. Competitive analysis

Before setting any pricing strategy, it’s essential to understand the lay of the land. This involves a thorough examination of competitors’ offerings, rates, amenities, and even guest reviews. By gauging the strengths and weaknesses of other hotels in the vicinity, one can identify unique selling points and potential market gaps.

Step 2. Forecasting

Forecasting involves predicting future demand for rooms. By analysing historical data, current bookings, local events, and even broader market trends to identify patterns, your hotel can anticipate busy and quiet periods. This foresight is crucial in determining pricing and promotional strategies.

Step 3. Pricing

Once there’s a clear understanding of your costs, market demand, your current and desired guest segments and the competitive landscape, you can set room rates. The best strategists do not set a static figure; timely and effective pricing strategies adjust rates in real-time based on current demand, ensuring that your property can maximise revenue during peak times and maintain or grow occupancy during quieter periods.

Step 4. Inventory management

Along with managing inventory per rate-type, inventory management considers how rooms are allocated across your booking channels, optimising the mix of direct bookings, online travel agency reservations (OTAs), traditional travel agents and everything in between. It’s about ensuring that rooms are available when they’re most likely to be booked, at the most profitable rates and the lowest acquisition cost.

Step 5. Monitoring and review

The world of hotel revenue management is ever-evolving, making consistent reviews imperative. By continuously monitoring performance metrics, guest feedback, and market changes, you can refine your strategies, making adjustments to pricing, promotions, or distribution channels as needed.

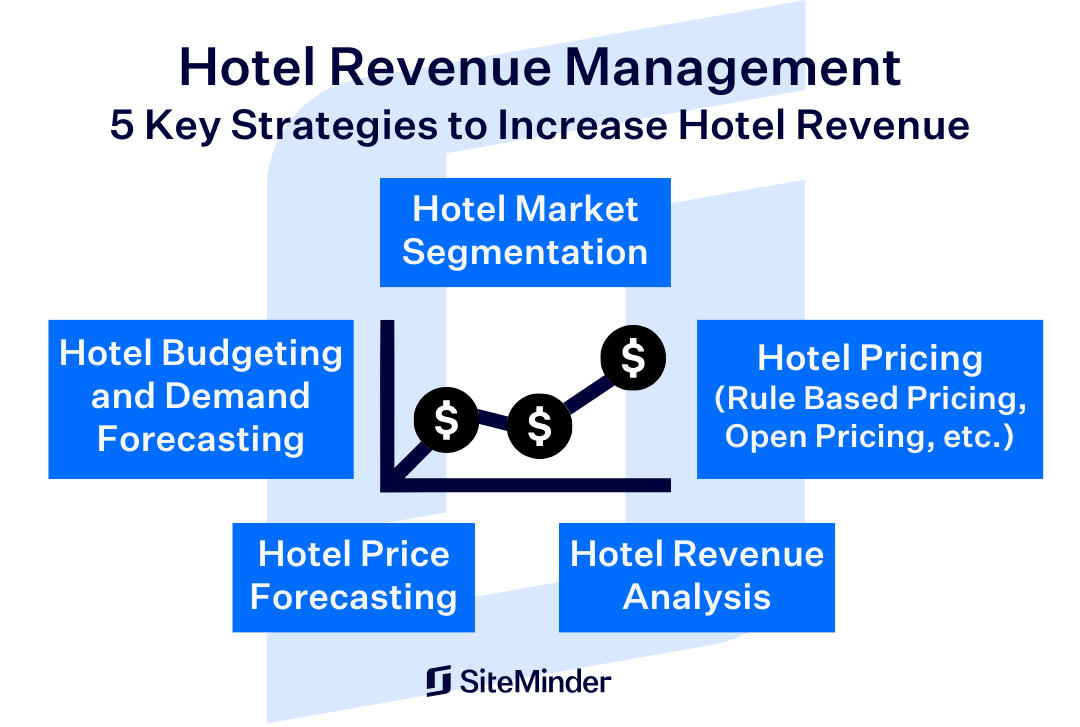

What are some important revenue management strategies?

Revenue management strategies, such as pricing, market segmentation, price forecasting, budget, and revenue analysis, are critical for any hotelier to create a revenue management strategy that is adaptable to the current conditions. And more often than not (at least at first), it’s much more important to focus on your own business – with full confidence in your strategy – than to worry too much about competitors.

Every hospitality business strategy has to have the customer at its heart. It’s vital you have an idea of your audience’s consumer behaviour if you want to squeeze the most value out of each guest that enters your door.

Factors to consider may be:

- How are travellers behaving in the current landscape?

- How do they book and travel?

- How do they experience and explore?

- What do they require?

- What are their expectations?

In hotel revenue management, an important aspect of strategic development is ‘Guest Segmentation’. Once you know the type of guests available to you, you will be able to tailor pricing, marketing strategies, and services to meet the specific needs and preferences of each segment, maximising revenue potential and enhancing guest satisfaction.

Guest segmentation allows hotels to identify high-value segments, target them with tailored promotions and packages, and differentiate their offerings in a competitive market landscape.

Understanding the unique characteristics, behaviors, and preferences of different guest segments, hotels can effectively allocate resources, optimise room rates, and personalise the guest experience to drive loyalty and repeat business. It also allows a deeper level of understanding of your property’s performance during strategic planning.

Let’s go into five major strategies that will help you gain revenue and increase profit.

1. Hotel pricing

There’s no single pricing strategy that works for all hotels. Each individual property must consider a pricing strategy (or strategies) that work best for their particular brand. A revenue manager should spend some time analysing data, identifying patterns, and interpreting trends and other influential factors to ensure the business is operating with the best possible chance to maximise income.

There are a number of questions you should ask yourself surrounding pricing strategies:

- What will attract guests to your property?

- Which strategy will best complement the business mix?

- How will strategies affect connected channels and distribution partners?

- How does your strategy utilise your channels?

- Who are the experts that can help determine the right strategy?

What do we mean by this? Let’s take a closer look at the first question as an example.

Certain guests will prefer or be accustomed to seeing particular pricing methods: some may like a cost breakdown of their stay per day, while others are happy with a total cost for their entire stay. So, this is where either Daily Pricing or Length of Stay pricing strategies might come into play.

Bearing in mind the above, the first priority and most important step of pricing strategies for hotels should be forecasting. This way you can predict demand and set prices based on raising hotel room rates as availability drops and demand increases, encouraging travellers to book early. This is an ideal pricing structure known as the “ascending model” whereby pricing increases closer to an arrival day. We’ll talk more about forecasting and analysis later.

Here’s a list of the most common and effective pricing strategies you can employ at your hotel.

Dynamic pricing

Dynamic pricing involves changing room rates based on real-time market data, which could occur daily. This type of strategy takes supply and demand into account and other factors that may affect market demand; competitor pricing, room availability, seasonality and other external aspects.

Within a dynamic pricing strategy, prices should vary based on supply and demand to improve revenue and ensure maximum occupancy.

This pricing option is well suited in today’s market and is one many hoteliers opt to use. Hotel revenue managers can use a revenue management system to help better understand trends in which they can modify the supply of rooms and adjust a pricing strategy whereby rates are implemented with the aim to increase sales and profitability.

Take advantage of the shifting market and raise your rates compared to keeping them static in order to earn more revenue.

Open pricing

Open pricing defines the flexibility hotels around the globe have to set their prices at different levels depending on the various target markets and distribution channels they deal with. It allows hotels to sell rooms at the best and most attractive price for a consumer and also the most profitable price for the property no matter the season or circumstances.

This type of pricing strategy ensures hotels never needlessly miss out on potential deals, booking or distribution channels; if there is availability for room bookings, it can be filled at a reasonable rate.

For example, a high-end hotel may usually attract guests with no budget constraints, but in the off-season bookings will drop and the hotel has more flexibility to drop rates, attracting travellers who normally would not be able to afford the stay.

While the average daily rate of the hotel will be lower, occupancy will remain steady and still work to maximise revenue.

Other hotel pricing strategies

There are numerous pricing strategies you can use at your hotel as part of your broader revenue management strategy, many of them in conjunction.

Here’s a list of the most common pricing strategies your hotel might find useful:

- Value-added pricing: Set room rates higher than the local competition and offer more extras in the basic package.

- Discount pricing: Most beneficial during slow seasons to boost occupancy by dropping base rates, where revenue can also be made up through other services in the hotel.

- Price per segment: Offering the same product at different prices to different market segments, such as a ‘family rate’

- Length of stay: Set a minimum number of days guests can book for when demand outweighs supply, in such cases, lower rates may not be necessary.

- Positional pricing: Basing your rates off brand strength and reputation.

- Penetration pricing: Positioning yourself as the cheapest in the market, however be mindful you’ll still need to retain the opportunity to sell at higher rates.

- Skimming: Positioning your hotel among the most expensive, clearly highlighting why customers are paying more to stay at your property.

2. Hotel market segmentation

Market segmentation is a key aspect of revenue management in the hotel industry. It allows you to differentiate between travellers who are coming to your hotel and devise unique and individual strategies for all of them.

For example, the approach you take for young adventurers will be very different to a business professional. Hotel market segmentation can be a little more complex than simply business vs leisure, but you can use it to discover trends within your hotel business.

One of the best ways to identify and filter segments is by their reason for travel; family holiday, wedding, tourist event, adventure, relaxation, business, etc. However, more and more hotels are adopting a different strategy completely known as a “blended segmentation”. This is the method of defining market segments by how a reservation was made, combining the reason for stay and method of booking e.g. Expedia as a market segment.

Hotel chains have adopted different applications of the traditional definition of a market segment and channels. Some identify a channel as an OTA and then identify the likes of Booking.com’s reward program and Expedia’s Egencia (for corporate travel) as sub-channels.

Further segmentation factors that you should take into account include:

- Length of stay

- Days of the week of stays

- Lead time (how long before arrival do they book)

- Cancellations

- No show ratio

Once you have a good understanding of market segments you can start to decide which groups your business wants to focus on more, and which to close out at different times of the year. By doing a deeper dive analysis, you might realise certain segments have higher cancellation rates and you could want to resist marketing to them.

Remember, each segment will have a unique opportunity for you to gain extra business or revenue.

Here’s a quick snapshot of the possibilities:

- Loyalty or rewards members – Offer discounts for next bookings and upsell other products at a lower rate

- Mobile booking – Use mobile exclusive promotions

- Direct bookings – Make offers that only exist on your website

- Walk-ins – Entice extra spending with your amenities displayed within the hotel for purchases during a booking

- Corporate – A chance to negotiate rates with large companies

- Online travel agents – Advertise special event packages

- Groups – Combine with tour operators and attractions

Every piece of analysis you do helps you build the optimal business mix for your hotel, so it’s important to look at all your options. If selling is a problem, there’s always an opportunity to adapt the current process or a new market to target. If spending is the problem, think of a way to entice customers to open their wallets again.

3. Hotel price forecasting

Forecasting is not only important for rate setting, but also for budgeting purposes. Accurate and effective forecasting requires a strong foundation in historical data. By budgeting and forecasting in advance you’ll have plenty of time and opportunity to make adjustments to your strategy.

If you know one point in the year is particularly valuable to your hotel, write your forecast immediately for that period a year in advance.

Key components of an effective forecast include:

- Occupancy

- Revenue

- Room rates

- Turnaways/Regrets/Denials – Tracking of reservations that are turned away or not booked, and is a critical measurement of demand. Ideally your turnaways are captured and measured on your online as well as direct/telephone requests.

- Spend per room

- Reservations

- Market trends

4. Hotel budgeting and demand forecasting

It’s a good idea to create a demand calendar prior to setting your budgeting plan so you know exactly what you’re dealing with. Most hotels forecast every day for the next 30 days and every week for the next 90 days.

A lot of hoteliers do this in a spreadsheet after extracting data from their PMS, but this is where you need a really high tech yet easy to use system – that can do it all in one place.

Take into account factors from last year and also trends for the upcoming year. Mark the following as things to track:

- RevPAR last year

- Groups or events, from past years and new ones to come

- Demand level indicator last year (High, Medium, Low, Distressed)

- Public/bank holidays

- School holidays

- Indications of increased demand

This will allow you to make informed pricing strategies based on solid data sets.

Before you reach your ideal budget you have to take into account influences such as sales resources, online marketing and distribution, refurbishment needs, and developments your competitor set is making.

Your budget should be developed on the basis of this question: at which rate and how many rooms can you sell for every future day? So you’ll need to have established how you’ll anticipate the business demand and the leisure demand per country, at which rate can you sell in the upcoming months, and how will your main corporate accounts behave?

There are two distinct demand measurements:

Constrained demand

The maximum demand for the amount of rooms limited by the physical inventory (the maximum number of bookings you could get based on the number of rooms)

Unconstrained demand

The maximum number of bookings you could get with unlimited rooms based on demand, where you’re not limited by the actual physical inventory.

You should still identify when unconstrained demand is above the capacity of the hotel; this is an important part of your hotel revenue management strategy. The unconstrained demand is useful for hotels as it can help you calculate your Last Room Value (LRV) for certain dates, and possible length of stay restrictions that may apply.

5. Hotel revenue analysis

Hotels will commonly benchmark against their competition to evaluate performance. It’s not the definitive way to track performance, nor should it be treated as a performance metric, but it does enable you to see where you stand and how travellers might react.

You’ll be required to benchmark on criteria such as:

- Prices

- Product (luxury, mid-range, budget-friendly)

- Level of service

- Location

- Distribution channel

Remember, a competitor is only a competitor if they’re targeting the same markets as you; even then you might not be competing for the same segments at the same time. However, if you can anticipate their strategies, making your own adjustments will become much easier.

When you complete a hotel analysis of your property against the competitor set, results can often look very different. Perhaps you thought you only had an average year, when in fact your competitors were much worse off and you were the stellar hotel in the area (or vice versa).

To benchmark for this, the Average Rate Index is a good way of looking at this. It measures your Hotel’s Average Daily Rate against the Market/Competitor ADR:

(Hotel ADR/Market (competitor) ADR) x 100

Example:

Hotel ADR = $85 vs Market ADR = $110

85 / 110 x 100 = Average rate index 77.27. In context, this means you only achieved 77% of the rate that your competitors did.

Based on this data, you’re then able to analyse to see how you can adapt your hotel revenue management strategy accordingly. To get an edge on your competitors, you can try to:

- Turn OTA bookers into direct bookers

- Offer additional extras or services

- Create special packages

- Work on your reviews

What are some tactics to increase hotel revenue?

Key tactics to increase hotel revenue include being easily bookable online, building a revenue-based culture, upselling hotel products and amenities, leveraging local events and attractions, fighting for direct bookings, prioritizing high-margin distribution channels, hiring skilled revenue managers, monitoring market demand, and deploying real-time pricing strategies.

The key driver behind any revenue tactic is ensuring customer satisfaction. If your product offering is universally recognized as quality, you have the foundations to charge a higher price.

If guests feel like they’re getting maximum value for their money, it’s very likely they’ll be willing to spend more. Getting more out of each individual guest who stays with you is a great way to increase the overall revenue of your hotel. For instance, guaranteed revenue from a guest you convince to stay an extra night by discounting the additional night might be worth your while, especially in low season.

Here’s a list of general tactics you can use to improve your hotel’s revenue stream:

1. Be easily bookable online

These days travellers enjoy the flexibility, convenience, and value of booking online. By starting to connect to online travel agents (or more OTAs) you’ll easily see an uplift.

2. Build a revenue based culture

Who’s on your revenue team? Everyone! Anticipatory service + proactive revenue-minded employee = emotionally connected customer with engaged loyalty and higher revenue returns.

3. Upsell other hotel products

Revenue opportunities extend far beyond simply selling your rooms. Think about the amenities you have on site and what you’re charging for them. Go even further by offering hotel guests the chance to purchase items like soap, utensils, bathrobes etc, specifically hotels that have a unique sense of style (boutique hotels are more likely to succeed with selling unique products used within their establishment).

4. Leverage local events and attractions

Events and attractions in the area are a great opportunity to curate packages for guests or offer additional services such as transport. The benefits are twofold; guests enjoy their stay more and your hotel generates more income.

As you move away from tactics and towards a completely developed strategy around your revenue and room sales, you also need to start thinking about and understanding your key performance indicators (KPIs). Once you know what you should be looking at you can start analysing the data and developing ways to manipulate them in your favour.

As a base, these are some metrics you can explore:

- Occupancy rate

- ADR (Average daily rate)

- RevPAR (Revenue per available room)

- TrevPAR (RevPAR + ancillaries)

- GOPPAR (Gross operating profit per available room)

- RevPASH (Revenue per available seat hour) – useful if you have a hotel restaurant

The principle that you should always keep in mind when choosing KPIs to benchmark against, is to assess market conditions in real-time and adapt accordingly.

5. Fight for direct business

Most independent hoteliers will be hard-pressed to consistently win business from OTAs in pure CPC-style auctions. More and more Metasearch channels, though, are giving hoteliers CPA/commission options and a guaranteed share of clicks. Two great hotel management examples include TripAdvisor’s Instant Booking product and HotelsCombined’s hotelier program, both of which offer participating hotels a more secure revenue stream.

It’s not just about Metasearch, though: your hotel should be prioritising any channels (social media, for example) where you can get more guests looking to make their booking directly on brand.com.

6. Prioritise channels that give you better revenue management opportunities

The more closely a channel can emulate the pricing strategy you’ve constructed in your RMS, the better it is likely to be for your bottom line.

Therefore, if an OTA affords you an easy way to yield reduced prices for longer stays, and if it is possible to configure offers and packages without jeopardising your business across other OTAs, then this presents a great opportunity to boost your margins.

Market managers at some OTAs can even provide you with data to help instruct your decisions: typically they can provide information such as how a new package is likely to boost conversion, average lead times on reservations, and more.

7. Hire the right people

If you invest in good talent, you will thank yourself later. If you are just starting in the revenue management journey, this is a critical investment. Hire the right person, who has the ability to analyse numbers, and more importantly is able to communicate what these numbers mean to an audience who isn’t familiar with revenue management.

It’s important to have a revenue manager who is able to communicate their strategies to all stakeholders. This allows everyone to understand why recommendations are being made and get behind it. Without being able to communicate effectively, the other stakeholders in your hotel would be reluctant to give it a shot.

8. Tap into market demand

You need to keep a pulse on market conditions and track the right metrics on a daily basis – and with a view to the future.

This is almost impossible to do manually, so look for a tool that:

- Provides real-time access to current market demand

- Allows for easy generation and exporting of reports

- Allows hoteliers to set rate strategy rules and be alerted instantly

Interestingly enough, Skift reports that less than 15% of the global hotel market is using revenue management technology, even though revenue management solutions have been in the market for over 25 years.

This may be because of the misconception that such technology is overpriced. But pricing intelligence tools like SiteMinder Insights exist to cater to those hotels that want real-time intelligence at an affordable price.

9. React fast and deploy pricing strategies in real-time

Making sure you’re able to quickly react and update your pricing instantly is key.

Everything needs to be accompanied by agile pricing management, and reacting very quickly to the market’s changes. To do so, you need a good channel manager that allows you to manage rates and availability, closing channels or rates plans in order to optimise your room sales.

This is why having a channel manager integrated with your property management system and booking engine is essential.

It’s fundamental to have the technological tools that help you to speed up the management of all the data and variables you analyse daily. You can use these reports to see how sales are performing in different channels.

With the right people and the right systems in place, a hotel is in the best position to maximise revenue for the business.

How do revenue management tools work?

An RMS enables you to carry out important revenue management tasks more efficiently and effectively. It helps to handle and make use of all the data your hotel produces – as well as the market at large – in order to help you to make more informed decisions.

It’s very likely everyone will be using some kind of technology system or solution to manage their hotel and price their rooms within the next few years. Many solutions already exist to help with this. Of course, one of these is a revenue management system, or RMS.

Without continued analysis of the information, rooms and services may be frequently overpriced or underpriced, leaving your hotel a step behind local competitors and confused about the profitability of the business.

This type of inconsistency can have a domino effect on the entire market. For example, if a hotel is constantly under-selling on the expected rate, they might inadvertently create a price war in their confusion because competitors may react in kind.

What are the benefits of hotel revenue management solutions?

Here’s how revenue management technology can help:

1. Less costly errors

An incorrect price at a small hotel will have a bigger impact on ADR and RevPAR. While larger hotels might be able to hide or easily overcome a pricing mistake, smaller hotels have less margin for error.

2. Get more revenue out of every room

With fewer rooms, maximising the rate for each room becomes more critical. The data your technology provides will help you understand who you should be targeting and when, helping to analyse what will be the most valuable demand for you, where you can decide whether to offer rates for group business and discounts for long stays.

To get your own pricing strategy right, you’ll need to compare against what your immediate competitors are doing. With a hotel business intelligence tool, you can get an instant all-in-one overview of your competitors’ rate activity, allowing you to concentrate on why they are adjusting and how or if you should respond.

3. An impression of a ‘bigger’ hotel

Large, branded hotels will already have an RMS in place and dedicated revenue managers to manage them. Independent hotels however may not be able to afford a robust solution, but pricing intelligence tools are an affordable substitute.

These use the data and its own algorithms to carry out a real-time analysis of the state of the market, and of demand, in order to calculate ideal room rates. With this increased data visibility and analysis capabilities, you’ll have more resources to compete with large hotel groups who are able to devote full-time staff to revenue management.

4. Manage your time efficiently

Automated market intelligence allows you to instantly access and act upon pricing data. Knowing when the market will be an easy sell-out or in a quiet period will not only enable you to optimise rates, but with a dependable forecast, you can organise your staff more effectively and improve the guest experience.

5. More time to be proactive

The more data you have access to, the less reactive you’ll be. Rather than reacting to your competitors blindly all the time, you’ll have a better understanding of demand and trends to make your own projections and set intelligent rates.

6. Understand your guests better

A RMS can tell you more about customer behaviour and allow you to better attract travellers towards more bookings. For example, do guests prefer it when your rate applies to every night of their stay or will they accept varying rates, or do they prefer a total stay price?

7. Data is easily stored in one place

Instead of combing through your own data, and then individually doing the same for competitors, an RMS will collate everything for you in one place. Depending on your system, you can do this for up to 15 competitors.